|

|

|

|

|

Each Office Independently Owned & Operated

Posted by: Tim Woolnough

|

|

|

|

|

Posted by: Tim Woolnough

|

|

|

|

|

|

|

| Dr. Sherry Cooper Chief Economist, Dominion Lending Centres |

Posted by: Tim Woolnough

Published by Sherry Cooper October 17, 2023

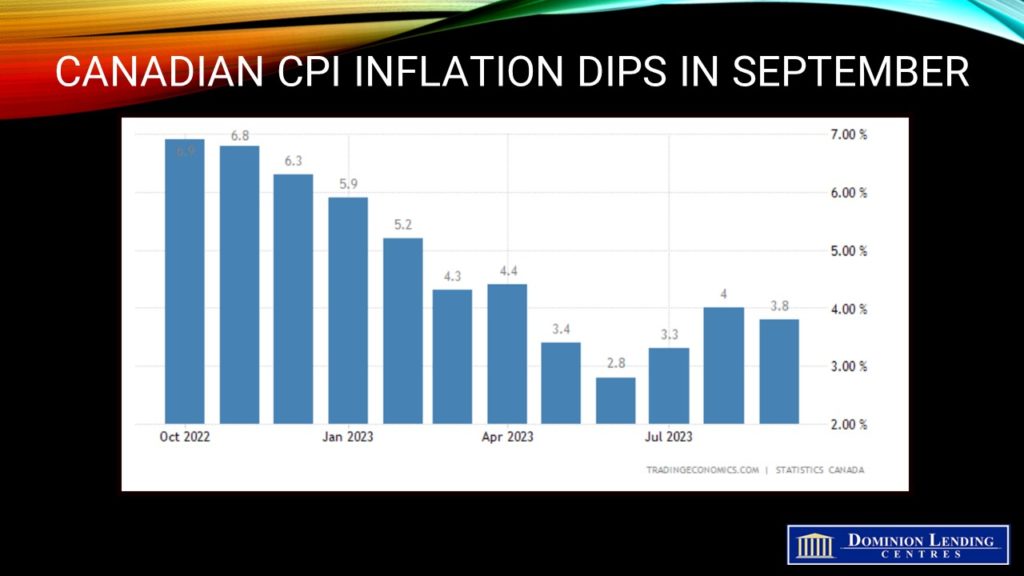

Today’s inflation report for September was considerably better than expected, ending the three-month rise in inflation. Not only did the headline inflation rate fall, but so did the core measures of inflation on a year-over-year basis and a three-month moving average basis. This, in combination with the weak Business Outlook Survey released yesterday, suggests that the overnight policy rate at 5% may be the peak in rates. While I do not expect the Bank to begin cutting rates until the middle of next year, the worst of the tightening cycle may well be over.

Offsetting the deceleration in the all-items CPI was a year-over-year increase in gasoline prices, which rose faster in September (+7.5%) compared with August (+0.8%) due to a base-year effect. Excluding gasoline, the CPI rose 3.7% in September, following a 4.1% increase in August. Looking ahead to the October inflation report, the base effect for headline CPI is favourable, as CPI surged in October 2022. Gasoline prices are down about 7% so far this month. Given the war in the Middle East, however, there is no guarantee that this will hold, but if it does, the October headline CPI could move into the low-3% range.

On a monthly basis, the CPI fell 0.1% in September after a 0.4% gain in August. The monthly slowdown was mainly driven by lower month-over-month prices for gasoline (-1.3%) in September. Goods inflation fell 0.3% from a month earlier, the first time since December 2022, and grew 3.6% from a year ago versus 3.7% in August. Services inflation was unchanged from August, the first time it hasn’t grown on a monthly basis since November 2021, while the rate slowed to 3.9% on a yearly basis, from 4.3% in August.

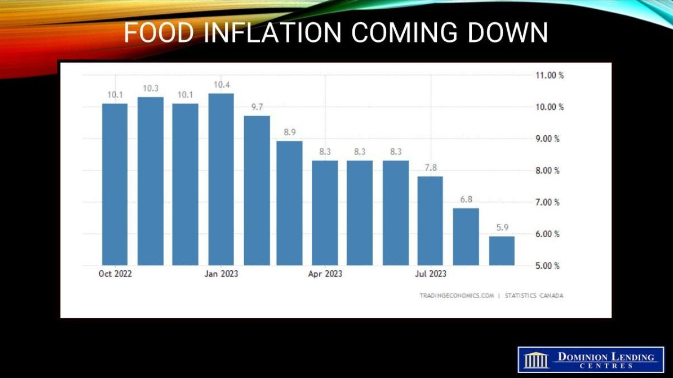

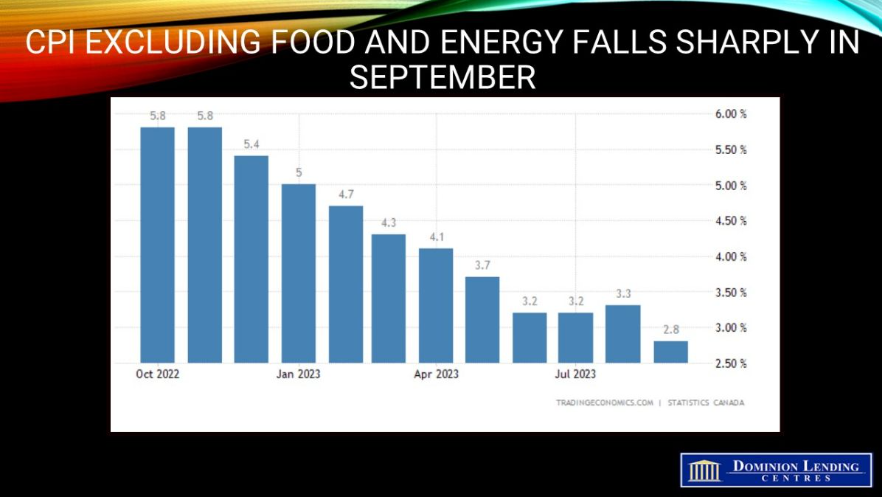

Yesterday’s Survey of Consumer Expectations showed that perceptions of current inflation remain well above actual inflation. One reason is the very visible level of grocery and gasoline prices. As the chart below shows, food inflation–though still elevated–decelerated to 5.9% last month, and CPI excluding food and energy fell to a cycle-low 2.8%. Large monthly gains in September 2022, when grocery prices increased at the fastest pace in 41 years, fell out of the 12-month movements and put downward pressure on the indexes.

Prices for durable goods rose at a slower pace year over year in September (+0.4%) compared with August (+1.4%). The purchase of new passenger vehicles index contributed the most to the slowdown, rising 1.7% year over year in September, following a 3.1% gain in August. The deceleration in the price of new passenger vehicles was partly attributable to improved inventory levels compared with a year ago.

Additionally, furniture prices (-4.6%) and household appliances (-2.3%) continued to decline year-over-year in September, contributing to the slowdown in durable goods. Consumers paid less on a year-over-year basis for air transportation (-21.1 %) in September, coinciding with a gradual increase in airline flights over the previous 12 months.

Other measures of core inflation followed by the Bank of Canada also decelerated.

Bottom Line

According to Bloomberg News calculations, “A three-month moving average of underlying price pressures that Governor Tiff Macklem has flagged as key to policymakers’ thinking fell to an annualized pace of 3.67%, from 4.29% a month earlier.” While this is still well above the Bank’s 2% target, the global economy is slowing, the Canadian and US economies are slowing, and with any luck at all, the Bank of Canada might see inflation move to within its target range next year. However, the central bank will be cautious, refraining from rate cuts until the middle of next year. The full impact of rate hikes has yet to be felt. The next move by the Bank of Canada could be a rate cut, but not until next year.

Posted by: Tim Woolnough

So, you need a tenant.

So, you need a tenant.If you have a basement suite or rental property and you are currently looking for a tenant, there are some things to know! Whether this is your first tenant or you have other rental properties, it is a good idea to familiarize yourself with the specifics to ensure a harmonious tenancy.

As always, your responsibility as the landlord is to keep your rental properties in good condition and ensure they meet health, safety, and housing standards. However, as a landlord, you also have additional responsibilities around the rental agreement and tenant regulations.

Tenancy Agreement

Landlords are required to prepare a written agreement for every tenancy. Bear in mind, if this agreement is not prepared the standard terms for your province will still apply, especially if a security deposit is paid. This agreement should clearly outline the following:

The tenancy agreement should also outline if there is the ability to add a roommate, and whether or not utilities, parking, storage, laundry, etc. are included.

Deposits

Typically, a security or damage deposit is requested by the landlord to establish tenancy and cover any unexpected issues that may arise. The deposit can be no more than half of the first month’s rent.

If you are charging a pet deposit fee, note that guide or service pets are exempt from any damage deposits. In addition, you cannot charge fees beyond the pet damage deposit.

Move In

To ensure the move-in goes smoothly, tenants and landlords should schedule a move-in time that works for everyone. At the beginning of the tenancy, you may also consider an inspection before the new tenant has moved in to ensure everyone is on the same page and the condition of the unit is clear in regard to any potential damages or fixes needed.

As a landlord, you are also responsible for changing the locks (at your cost) should the new tenant request it.

Additional Considerations

As a landlord, you will want to assess the suitability of any new tenant before signing the agreement. There are a few things you can do to ensure a smooth process and the right choice of tenant:

Once you have reviewed the above, you will be in a good position to determine if the potential tenant is a good fit for the rental space.

However, keep in mind that you cannot refuse to rent to a tenant based on any discriminatory aspects such as race, gender, sexual orientation, religion, etc. In addition, you cannot refuse to rent to individuals on income assistance.

While it can seem like a lot, with the proper preparation and understanding of tenant laws and regulations in your area, you can ensure a smooth and successful rental process!

Posted by: Tim Woolnough

The True Cost of Downsizing.

The True Cost of Downsizing.Many Canadians consider downsizing during their retirement years. Once their children have left the nest, the choice seems obvious: relocate to a smaller residence or a more affordable town and capitalize on the price difference. For many retirees, the funds from the sale of their home can significantly impact their overall lifestyle and financial well-being.

However, there are downsides of downsizing you should be aware of before you call your realtor.

Downsizing in Canada: A Cost Analysis

The cost of moving is probably one of the biggest downsides to downsizing. To give you an idea of the figures involved, we conducted a cost analysis for a typical downsizing scenario using an example of selling a home in Toronto for $1,000,000 and buying a condo for $700,000.

Theoretically, this would free up $300,000 in equity while moving you into a smaller home. According to Ratehub, you need a nest egg of $450,000 if you want to retire comfortably in Canada. The money from the sale of your home could have a meaningful impact on your retirement finances. But how much of that chunk will you get to keep to boost your nest egg? Below is an estimated list of cost considerations when choosing to downsize:

| Fees | Downsizing | Reverse Mortgage |

| Real estate fees (average 5% selling price) | $50,000 | N/A |

| Legal Fees | $1,200-$2,400 | $300-$600 |

| Land Transfer Tax (Varies depending on province and city) | $8,975 | N/A |

| Moving expenses (packing supplies, moving service, garbage removal, etc.) | $3,000-$6,500 | N/A |

| Furnishing and upgrades | $8,000-$25,000 | N/A |

| Home appraisal | $500 | $300-$600 |

| Closing fee | $500-,$1500 | $1,795-$2,995 |

| Total | $72,175-$94,875 | $2,395-$4,195 |

As you can see, downsizing could cost you between $72,175 – $94,875.

If you live in a big city like Toronto, $300,000 of equity could shrink to just $205,125* after considering these downsizing costs. However, these costs are not the only negative effects of downsizing to consider.

The Downsizing Dilemma

Many Canadians underestimate the financial and emotional costs of downsizing, overlooking various aspects:

An Alternative to Downsizing in Canada: A Reverse Mortgage

A Reverse Mortgage can be the ideal alternative to downsizing. Unlock up to 55% of your home’s equity in tax-free cash while staying in your beloved home without leaving the neighbourhood you love. This money improves your retirement finances and can be used to renovate and retrofit the home for accessibility and livability as you age. With no required monthly mortgage payments to make, a Reverse Mortgage is becoming a popular solution.

Book a strategy call with me to learn how a Reverse Mortgage can help you save on the stress and expense of downsizing and live the retirement of your dreams.

*Based on $300,000 of equity minus $94,875 (the highest downsizing cost).

Posted by: Tim Woolnough

Mortgage Portability.

Mortgage Portability.When it comes to getting a mortgage, one of the more overlooked elements is the option to be able to port the loan down the line.

Porting your mortgage is an option within your mortgage agreement, which enables you to move to another property without having to lose your existing interest rate, mortgage balance and term. Thereby allowing you to move or ‘port’ your mortgage over to the new home. Plus, the ability to port also saves you money by avoiding early discharge penalties should you move partway through your term.

Typically, portability options are offered on fixed-rate mortgages. Lenders often use a “blended” system where your current mortgage rate stays the same on the mortgage amount ported over to the new property and the new balance is calculated using the current interest rate. When it comes to variable-rate mortgages, you may not have the same option. However, when breaking a variable-rate mortgage, you would only be faced with a three-month interest penalty charge, which is much lower than the average penalty to break a fixed mortgage. In addition, there are cases where you can be reimbursed the fee with your new mortgage.

If you already have the existing option to port your mortgage, or are considering it for your next mortgage cycle, there are a few considerations to keep in mind:

To get all the details about mortgage portability and find out if you have this option (or the potential penalties if you don’t), book a call with me today for expert advice and a helping hand throughout your mortgage journey!

Posted by: Tim Woolnough

How to Talk to Your Kids about Finances.

How to Talk to Your Kids about Finances.Financial independence is a critical skill for future success that your children will not learn anywhere else. Not only does financial literacy help your children have more success in life, but it allows them to move out sooner and it avoids delaying your retirement with additional expenses to support them.

So, how do you teach your children about money?

Remember, you are the best example to your children about money. Don’t be afraid to share the ups and downs with them. Be patient with your kids, but don’t give up! The best thing you can do as a parent is to promote financial security and independence.

Posted by: Tim Woolnough

Strata Insurance: The Importance of Deductible Coverage.

Strata Insurance: The Importance of Deductible Coverage.Strata insurance has been steadily rising across Canada, but many homeowners are unaware of changes to their policies. In some areas, deductibles are doubling (or even tripling!), which can result in extremely high costs if you are not updating your individual policy.

To ensure that you remain up-to-date with your strata insurance policies, it is vital that homeowners living within a strata building check with their strata management for a copy of the most recent insurance policy. While it is good to check over the entire policy, a few key areas to review are your deductibles and comparing your coverage with your individual homeowner policy to ensure all gaps are filled.

Unfortunately, many homeowners within strata buildings do not realize the importance of having individual coverage. Typically, strata insurance covers the building itself. This means that, in the event of an accident, such as a fire or flood, the building can be re-established. Unfortunately many homeowners think this is enough coverage, but it is equally important to ensure that you have your own individual homeowners insurance policy.

The purpose of an individual policy is to help to protect the contents of your apartment, townhouse or condo in the event of an accident. This means that any upgrades you made to your unit would be covered, as well as your belongings. More importantly, however, is these policies also serve to fill in the cost gap relating to the strata building deductible.

Historically, deductibles in strata managed buildings averaged $25,000. This means that, in the event of an accident (flooding, fire, etc.), you would need to pay $25,000 upfront to have the repairs made. However, as the costs of strata insurance increases across the country, these deductibles are changing.

For many homeowners, there has been no change to the insurance cost or strata fees, leaving them unaware of any adjustments to their policy. Instead, the changes are being made directly to the deductible to cover the increased costs. In fact, in some cases the deductibles are doubling or even tripling, leaving homeowners with a hefty bill in the case of insurance coverage. Instead of having a $25,000 deductible, many homeowners are seeing this increase up to $250,000.

With so many increases to various fees and changes to policies within strata organizations, it has become even more important to maintain vigilance and be aware of any changes to your strata policies. Typically, these are shared with homeowners via meeting minutes and e-mails which every homeowner in a strata building should have access to.

If you receive any updates from your strata management, you must be sure to review them. Always take your strata and individual policy to an insurance agent to ensure you are aware of your coverage and that your individual homeowner’s policy is working in your favor. Investment property owners especially need to check their existing deductible against the updated deductible and insurance policies to avoid any future issues.

Posted by: Tim Woolnough

It’s Time to Crush Your Credit Card Blues.

It’s Time to Crush Your Credit Card Blues.Although credit cards interest rates have not been affected by the recent surge in the prime lending rate, the fact remains that credit card debt is usually the most expensive debt you can have. The average is around 20% and even the so-called ‘low interest’ cards carry a rate in excess of 10%. Expediting the demise of your credit card balance should be the number one focus for anyone looking to improve their financial situation. Here are five actions to get you started.

The above tips will help you get started on the road to eliminating your credit card balance. There are no shortcuts and it may require a lot of sacrifice depending on how much debt you have, but the mental burden that lifts when you see a big zero under “balance due” it will be worth it!

Posted by: Tim Woolnough

Market Beware: Subject Free Offers.

Market Beware: Subject Free Offers.When it comes to purchasing a home, most offers include conditions or subjects, which are requirements or criteria to be met before the sale can be finalized and the property is transferred. Some of the most common subjects include:

The purpose of these subjects is to protect the buyer from making a poor investment and ensure that there are no hidden surprises when it comes to financing, insurance, or the state of the property.

These conditions are written up in the purchase offer with a date of removal. This is agreed to by the seller before the sale is finalized. Assuming the subjects are lifted by the date of removal, the sale can go through. If the subjects are not lifted (perhaps financing falls through or something is revealed during the home inspection), the buyer can waive the offer and the purchase becomes void.

However recently, especially in heightened housing markets, there has been an emergence of subject-free (or condition-free) offers. These are purchase offers that are submitted without any criteria required! Essentially, what you see is what you get.

Below we have outlined the impact of subject-free offers on both buyers and sellers to help you better understand the risks and outcomes:

Pros of Subject-Free Offers

Cons of Subject-Free Offers

Financing Around Subject-Free Offers

When submitting a subject-free offer, it is essentially up to the buyer to do as much due diligence as possible before submitting. They will need to identify what the lender is looking for to make sure they walk away with a mortgage. Though approval is never certain, prospective buyers placing a subject-free offer should do their very best to secure financing beforehand.

Contractual Obligations

Be mindful when it comes to purchasing offers versus purchase agreements. While your purchase offer is a written proposal to purchase, the purchase agreement is a full contract between the buyer and seller. The purchase offer acts as a letter of intent, setting the terms you propose to buy the home. If financing falls through, for example, then the contract is breached and this is where the buyer may lose the deposit.

It is also important to be aware of a breach of contract in the event that a seller chooses to take action. For example, if you submit a subject-free offer of $500,000 and cannot secure financing for that offer and the seller turns around and is only able to get a $400,000 deal with another buyer, they could potentially sue the initial buyer for the difference due to breach of contract.

Preparing a Subject-Free Offer

If you have decided to go ahead with a subject-free offer, regardless of the risks, there are some things you can do to mitigate potential issues, including:

While there are things that can be done to help with subject-free offers, it is still risky. Ultimately submitting an offer with subjects gives you the time and ability to gather information on the above, as well as access to the property or home for inspections.

If you are intent on submitting a subject-free offer, be sure to discuss it with your real estate agent as they can determine if a subject-free offer is necessary, or if perhaps a short closing window would suffice to seal the deal. A good realtor will keep you informed of potential interest and other bids during the process as well. Their goal should be to maximize your opportunity and minimize your risk. In addition, before making any offers, be sure to check with me to discuss your mortgage and financing so you can make the best decision.